Earned Income Tax Credit (EITC)

You qualify for EITC if:

- you have earned income and adjusted gross income within certain limits; AND

- you meet certain basic rules; AND

- you either:

- meet the rules for those without a qualifying child; OR

- have a child that meets all the qualifying child rules for you, or your spouse if you file a joint return.

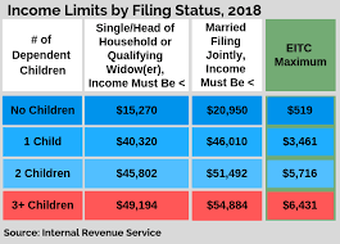

Here is the Earned Income Tax Credit table for the 2018 tax year:

BASIC RULES:

Social Security Number

You, your spouse and any qualifying child you list on your tax return must each have a Social Security number that is valid for employment that was issued before the due date of your return (including extensions).

Filing Status You must file:

- Married filing jointly

- Head of household

- Qualifying widow or widower

- Single

Income Earned During 2018

- Your tax year investment income must be $3,500 or less for the year.

- Must not file Form 2555, Foreign Earned Income or Form 2555-EZ, Foreign Earned Income Exclusion.

- Your total earned income must be at least $1.

- Both your earned income and adjusted gross income (AGI) must be no more than the threshold (See image above)

Additional Rules

I Have a Qualifying Child

If you, and your spouse if filing a joint return, meet the criteria above and you have a child who lives with you, you may be eligible for EITC. Each child you claim must pass the relationship, age, residency and joint return tests to be your qualifying child.

I Don't Have a Qualifying Child

If you and your spouse, if filing a joint return, meet the basic EITC rules for everyone, you qualify for EITC if:

I Have a Qualifying Child

If you, and your spouse if filing a joint return, meet the criteria above and you have a child who lives with you, you may be eligible for EITC. Each child you claim must pass the relationship, age, residency and joint return tests to be your qualifying child.

I Don't Have a Qualifying Child

If you and your spouse, if filing a joint return, meet the basic EITC rules for everyone, you qualify for EITC if:

- You resided in the United States for more than half of the year; AND

- You cannot be claimed as a dependent or qualifying child on anyone else's return; AND

- You must have been at least 25 but under 65 years old at the end of the tax year.