INDIVIDUAL TAX PREPARATION

For your Individual Tax Preparation our fees could range from $350-$1250. Now before you freak out and say I cannot afford this and hit that X button or swipe back button, your fees can range based on complexity of your tax return.

We try to maintain historical fees for our returning clients. We do not charge you based on tax forms or your tax refund but your fee depends on amount of time that is required to complete your tax return correctly and accurately.

We only have valuable time to spend on your return and only our services to sell you which is not refundable. We believe in quality and not quantity, and we certainly do not believe in providing cheap services. Our services entail years of experience, knowledge, staying abreast with consistent tax law changes, and continuing tax education.

The time frame to complete your tax return accurately depends on complexity of a return and if you have provided us all the documents.

NOTE: All documents must be received in our office by March 20th every year or an extension will be filed. Surcharge fee will be added if you like us to file your tax return by due date (fee depends on the complexity of the returns).

The events that could change your fee as it will require more preparation time includes the following, but not limited to:

Preparing your tax return could be very challenging and may leave you with more questions than answers. Due to constant changes in tax laws, a relatively simple return can be confusing. You may overlook simplest deductions and credits that you are entitled. Even with a user-friendly computer tax software, a simple mistake could cost you more. This gives you the whole reason to get your taxes done by a professional and experienced tax professional.

Now, we don't want Uncle Sam to take any more money from us, do we?

We try to maintain historical fees for our returning clients. We do not charge you based on tax forms or your tax refund but your fee depends on amount of time that is required to complete your tax return correctly and accurately.

We only have valuable time to spend on your return and only our services to sell you which is not refundable. We believe in quality and not quantity, and we certainly do not believe in providing cheap services. Our services entail years of experience, knowledge, staying abreast with consistent tax law changes, and continuing tax education.

The time frame to complete your tax return accurately depends on complexity of a return and if you have provided us all the documents.

NOTE: All documents must be received in our office by March 20th every year or an extension will be filed. Surcharge fee will be added if you like us to file your tax return by due date (fee depends on the complexity of the returns).

The events that could change your fee as it will require more preparation time includes the following, but not limited to:

- Sale of home

- Rental properties

- 1031 Like-kind exchange

- Multiple state tax returns

- Foreign Tax Return/Earned Income exclusions

- Debt Cancellation

- Non-US citizens

- Small business, home office

- Extensive tax treaty research

- Multiple Investment Accounts, Stock, RSU's, etc.

Preparing your tax return could be very challenging and may leave you with more questions than answers. Due to constant changes in tax laws, a relatively simple return can be confusing. You may overlook simplest deductions and credits that you are entitled. Even with a user-friendly computer tax software, a simple mistake could cost you more. This gives you the whole reason to get your taxes done by a professional and experienced tax professional.

Now, we don't want Uncle Sam to take any more money from us, do we?

3 Step Process:

Step 1: Sign Client Authorization Form - Electronic signature (if filing jointly separate emails are required) - Click here to sign

Step 2: Get Access to Client Portal - You will receive email from us to create account

Step 3: Upload documents - List of documents will be provided

Step 1: Sign Client Authorization Form - Electronic signature (if filing jointly separate emails are required) - Click here to sign

Step 2: Get Access to Client Portal - You will receive email from us to create account

Step 3: Upload documents - List of documents will be provided

Want to move forward? Please Call us!

|

You can complete and upload 1040 Checklist, client authorization form and extension form on the client portal

You can access the PDF format of our Client Authorization Form here as well as electronic.

|

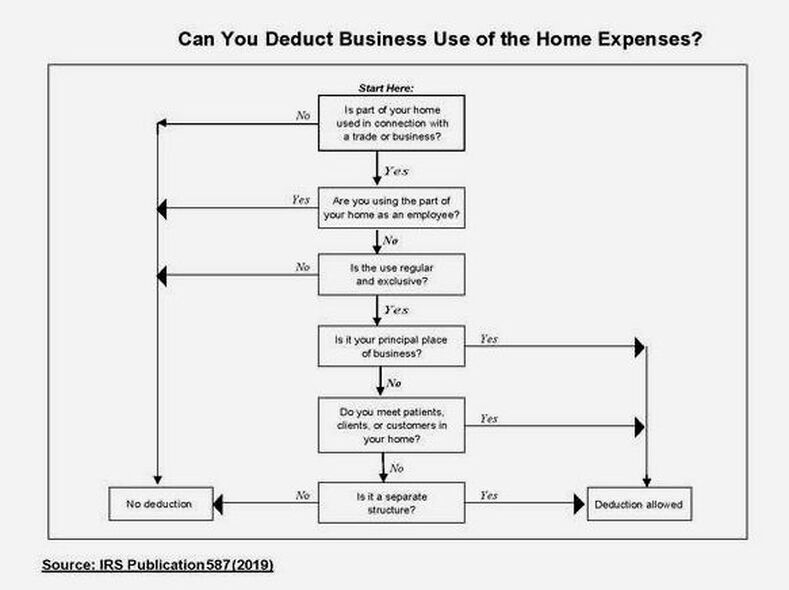

Can I Deduct Business Use of the Home Expenses?

See the chart below

See the chart below

Here's what you can expect to get from our tax preparation services...

* Your tax return will be checked and then re-checked with our professional software to ensure accuracy.

* Your federal and state tax return is filed electronically so you will receive your tax refund quicker in your bank account.

* Your are entitled for maximum refund and we will look for those deductions that you deserve.

* Most Importantly, you pay a reasonable fee for entrusting us in doing your taxes.

* Your tax return will be checked and then re-checked with our professional software to ensure accuracy.

* Your federal and state tax return is filed electronically so you will receive your tax refund quicker in your bank account.

* Your are entitled for maximum refund and we will look for those deductions that you deserve.

* Most Importantly, you pay a reasonable fee for entrusting us in doing your taxes.